YAMASHIN-FILTER’s ESG-driven Management

In line with our corporate philosophy of “仕濾過事” (Rokajinitsukafuru) or “Contribute to society through the filtration business,” we will reinforce our ESG management toward realizing a sustainable society and helping to solve diverse social issues.

We have adopted “仕濾過事”(Rokajinitsukafuru: Contribute to society through the filtration business), which has been our corporate philosophy for more than half a century since our founding, as our Group’s sustainability policy. Going forward, while taking into account the positive and negative impacts that the YAMASHIN-FILTER Group’s business activities have on society and on the environment, we will promote ESG-driven management that reflects the expectations and concerns of our many different categories of stakeholders.

Sustainability Policy

仕濾過事” (Rokajinitsukafuru) - “Contribute to society through the filtration business”

In line with our corporate philosophy of “仕濾過事” (Rokajinitsukafuru) or “Contribute to society through the filtration business,” and with the aim of helping to realize a sustainable society, YAMASHINFILTER is contributing toward solving society’s problems relating to Environment, Air quality and Health, by making effective use of the strengths that we have cultivated in our filter business.

We established the Yamashin Sustainable Solutions (YSS) Committee as an advisory body for the President in FY2021. The committee is chaired by the head of the Management Planning Office, who also serves as an executive officer, and has a membership of around 20 people, including all of the company’s executive officers.The YSS Committee meets once a month to discuss initiatives relating to promotion of SDGs and ESG. The content of their discussions is reported to the Board of Directors and the Management Conference.

Main Topics Addressed by the YSS Committee in FY2023

- Formulation of environment and society KPIs

- Updating information disclosure in keeping with TCFD recommendations

- Medium- to long-term CO2 emission reduction targets

- Measures to reduce CO2 emissions

Other

Since the establishment of the YSS Committee, we have held sustainability training and workshops for employees. In addition to basic topics such as sustainability, SDGs, and TCFD, we have held several human rights risk study sessions on formulating human rights policies and evaluating human rights risks.

Since FY2024, we have also added sustainability lectures as part of new employee training, leading to greater awareness through sharing the progress of company targets and initiatives, including materiality.

Following the process outlined in the GRI sustainability reporting standards, in line with our corporate philosophy of “仕濾過事” (Rokajinitsukafuru) or “Contribute to society through the filtration business,” and with YAMASHIN-FILTER’s approach to value creation, we have identified materiality (key issues) for the group. To determine these materiality items, the YSS Committee took a wide-ranging look at social and environmental issues, followed by a six-month period of discussion of the company’s relationship and approach to these items, after which the materiality items were approved by the Management Conference.

Collation of issues

- Candidate materiality items were identified with reference to the items included in relevant guidelines and frameworks, considering their relevance to the YAMASHIN-FILTER Group’s business areas and key initiatives.

- Candidate materiality items were collated by theme from the two perspectives of the company’s ability to contribute to social development (positive impacts) and the fundamental social responsibility that the company bears (negative impacts).

- Study sessions for executive officers were held to deepen understanding of these candidate items.

Referenced guidelines, frameworks, etc.:

GRI Standards, ISO 26000, SDGs, ESG evaluation items from FTSE and MSCI

Assessment of importance and formulation of draft proposals

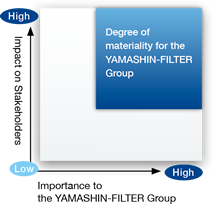

- The importance of the candidate materiality items collated in Step 1 was assessed based on two criteria: impact on stakeholders, and importance to the YAMASHIN-FILTER Group. Weighting was attached to each materiality item based on a survey of executive managers.

- A draft version of the materiality and commitments was drawn up.

Confirming appropriateness and obtaining organizational approval

- When formulating and discussing the draft materiality and commitments, meetings at which the YSS Committee exchanged views with external experts and internal discussion meetings were held over a period of more than six months.

- The identified materiality items and the associated draft commitments were reported to and approved by the Management Conference.

Based on the materiality that we have identified, we are putting in place the required management system and promoting initiatives, including the setting of strategies that need to be implemented and key performance indicators (KPIs) for each materiality item, as well as assigning managerial responsibilities and determining management methods, etc. In November 2024, we formulated the Medium-Term Management Plan 2027, which outlined the “promote ESG management” as one of its strategies. We also set the targets of achieving a “FTSE score of 4.0 or more” and “acquiring a CDP Climate Change Score of A” by the end of March 2028 as non-financial KPIs. We continue to promote sustainability initiatives focused on materiality items and aim to improve the transparency of sustainability information through disclosure documents such as sustainability reports and CDP.

As well as being evaluated by ESG assessment bodies, our trusted business endeavors are well-regarded by our customers.

Responding to CDP Climate Change 2023, conducted by CDP, an international non-profit organization that assesses the environmental efforts of companies and government bodies, we obtained a “B” score in February 2024. CDP assesses based on eight ranks (A, A-, B, B-, C, C-, D, D-). The B score is the third highest management level and indicates that an entity has recognized its environmental risks and impacts, while taking coordinated actions on environmental issues. In FY2023, we improved on our FY2022 score of “D” by four ranks.

YAMASHIN-FILTER CORP. was selected for the second year running as a component stock included in the FTSE Blossom Japan Sector Relative Index, created by FTSE Russell to reflect the performance of Japanese companies that relatively excel in terms of ESG responsiveness in their sectors.

*FTSE Russell (registered trademark of FTSE International Limited and Frank Russell Company) confirms that as a result of a third-party investigation, YAMASHIN-FILTER CORP. has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE Blossom Japan Sector Relative Index. The FTSE Blossom Japan Sector Relative Index is widely used to create and evaluate sustainable investment funds and other financial products.

The YAMASHIN-FILTER Group’s reliable supply system , contribution to greater work efficiency, and initiatives such as activities to raise awareness are well-regarded by our customers. We will continue to increase customer satisfaction and corporate value through developing products that bring to life more sophisticated needs and resolve issues, supplying high quality products on a global scale and providing support.

|

Client’s Name |

Details of Award |

|---|

|

Kobelco Construction Machinery Southeast Asia Co., Ltd. |

Best Performance for Delivery Control Award 2023 KCMSA, a Southeast Asian-based company that primarily produces hydraulic excavators by sourcing supplies from 72 suppliers, including us, praised YAMASHIN THAI Ltd. for having an extremely high on-time delivery rate of 99%+. |

|

Komatsu Parts Asia Co., Ltd. |

Best Collaborative Partner Award 2023 We were recognized for our initiatives and contribution to promoting the sales of genuine Komatsu service parts, which we supply. |

|

PT Komatsu Marketing and Support Indonesia |

Best Supply Fulfillment Award We were praised for ensuring delivery deadlines were met and for providing exceptional customer service. |

|

Hitachi Construction Machinery Asia and Pacific Pte. Ltd. |

Appreciation Award YAMASHIN THAI Ltd. was recognized for its contribution through initiatives to promote sales of genuine Hitachi Construction Machinery service filter parts, which we supply, and for making improvements by streamlining product distribution. |

|

Hitachi Construction Machinery Thailand Co., Ltd. |

Supply Chain Excellence Award We were praised for contributing to improvements through streamlining Hitachi Construction Machinery Thailand’s product distribution. |

|

Caterpillar Inc. (USA) |

Caterpillar Supplier Excellence Award 2024 We were recognized for our tremendous contribution to Caterpillar’s activities to manufacture a wide range of products by reliably supplying products worldwide. For this, we were presented with Caterpillar’s ultimate award, which is given to companies in the top 4% of its 12,000 suppliers. |